Loans can be a helpful financial tool, whether you’re buying a car, funding a business, or consolidating debt. However, with countless loan options available, selecting the right one can feel overwhelming. This guide will help you understand different types of loans, assess your needs, and make an informed decision.

Common Types of Loans

Understanding the most common loan types is the first step to making the right choice:

- Personal Loans:

- Unsecured loans typically used for general purposes like home improvements or medical expenses.

- Interest Rates: Vary based on credit score; higher for unsecured loans.

- Auto Loans:

- Specifically for purchasing vehicles. These loans are secured by the car itself.

- Terms: Usually 3–7 years, with competitive interest rates.

- Mortgages:

- Long-term loans designed for purchasing real estate.

- Options: Fixed-rate mortgages offer stable payments; adjustable-rate mortgages (ARMs) may start lower but can fluctuate.

- Student Loans:

- Designed for educational expenses. Federal loans often have lower interest rates and flexible repayment options compared to private loans.

- Business Loans:

- For funding startups, expansions, or operational needs. These can be secured or unsecured.

Alternatives to Loans: What to Do When You Need Money Quickly?

Legal Nuances of Microloans: What to Watch Out For

Assess Your Financial Needs

To choose the right loan, start by identifying your financial goal:

- Are you financing a large purchase like a home or car?

- Do you need quick cash for a short-term need?

- Is the loan for personal use or a business venture?

Once you’ve defined your purpose, calculate how much money you need and how much you can realistically afford to repay each month.

Loans Secured by Jewelry: How to Avoid Mistakes

Differences Between Microloans, Loans, and Credit

Key Factors to Consider When Choosing a Loan

When comparing loan options, focus on these critical factors:

- Interest Rates:

- Fixed vs. variable rates: Fixed rates remain the same throughout the loan term, while variable rates may change.

- Compare annual percentage rates (APRs) across lenders to understand the total cost of borrowing.

- Repayment Terms:

- Shorter terms generally have higher monthly payments but lower total interest.

- Longer terms reduce monthly payments but increase the overall cost.

- Fees and Penalties:

- Look for hidden costs such as origination fees, late payment penalties, or prepayment fees.

- Eligibility Requirements:

- Understand the lender’s requirements for credit scores, income levels, and collateral (if required).

- Flexibility:

- Some lenders offer options to defer payments, skip a payment, or adjust terms during financial hardship.

Small Loans: What Are They and How to Get Them?

What Services Do Pawnshops Offer Beyond Collateral Loans?

Secured vs. Unsecured Loans

Loans are typically categorized as secured or unsecured:

- Secured Loans:

- Backed by collateral (e.g., a car, home, or savings account).

- Lower interest rates but risk of losing the collateral if you default.

- Unsecured Loans:

- No collateral required, making them riskier for lenders.

- Higher interest rates and stricter approval requirements.

Choose a secured loan if you have valuable assets and want lower rates, or an unsecured loan if you prefer not to risk your property.

Risks and Benefits of Loans Secured by Jewelry

Do Pawnshops Offer Small Loans?

Where to Find the Best Loans

Researching lenders is crucial to finding the best loan for your needs:

- Banks: Offer stability and competitive rates for customers with strong credit.

- Credit Unions: Provide lower rates and fees for members.

- Online Lenders: Convenient and often faster approval, but rates can vary widely.

- Peer-to-Peer Lending: Connects borrowers with individual investors through platforms like LendingClub.

Tips for Loan Approval

To increase your chances of approval, follow these steps:

- Improve Your Credit Score: Pay bills on time, reduce debt, and correct any errors on your credit report.

- Provide Accurate Documentation: Gather pay stubs, tax returns, and bank statements.

- Compare Offers: Shop around for prequalification to understand your options without impacting your credit score.

Microloans and Short-Term Loans: How to Find the Best Option

Pitfalls and Risks of Collateral Loans: How to Avoid Unpleasant Surprises

Alternatives to Traditional Loans

If a traditional loan isn’t the right fit, consider these alternatives:

- Credit Cards: Useful for small, short-term needs, but watch for high interest rates.

- Line of Credit: A flexible option that allows you to borrow as needed up to a certain limit.

- Borrowing from Family or Friends: Approach with caution and clear agreements to avoid straining relationships.

- Pawnshop: Customers can extend their loan period by paying the accrued interest, allowing more time to repay the principal.

Conclusion

Choosing the right loan requires understanding your financial goals, comparing options, and considering your repayment ability. Whether you’re looking for a personal loan, mortgage, or business loan, taking the time to research and plan ensures you make the best decision. With careful consideration, a loan can be a powerful tool to achieve your dreams and secure your future.

The Energy of Candles: How Colors and Rituals Are Used in Magic

Candles have captivated human imagination for centuries. Their warm, flickering light creates an ambiance of mystery, focus, and reverence, making them indispensable tools in spiritual and magical practices. From ancient rituals to modern-day spellwork, candles act as bridges between the physical and spiritual realms. They represent transformation, illumination, and the power of intention.

Read more ...Risks and Benefits of Loans Secured by Jewelry

Loans secured by jewelry, also known as collateral-based loans, are a common option for individuals needing quick access to cash. By offering valuable items such as gold, diamonds, or luxury watches as collateral, borrowers can obtain funds without undergoing credit checks or lengthy approval processes. However, like any financial decision, this option comes with its own set of risks and benefits.

Read more ...How to Train a Rottweiler: A Comprehensive Guide for Owners

Rottweilers are intelligent, loyal, and strong-willed dogs that require consistent training to thrive as loving companions. Proper training not only builds a strong bond between you and your dog but also ensures they grow into well-mannered and confident pets. This guide provides essential tips and techniques for training a Rottweiler, whether you’re starting with a puppy or working with an adult dog.

Read more ...The Mystical Properties of Natural Gemstones: Unlocking Their Spiritual Power

Natural gemstones have been revered for centuries for their beauty, energy, and healing properties. These gifts from the Earth are believed to hold vibrations that can influence our emotions, thoughts, and physical well-being. Whether you’re seeking balance, protection, or spiritual growth, natural stones offer a variety of benefits. In this guide, we’ll explore the mystical properties of some of the most popular stones and how to incorporate them into your daily life.

Tips to Protect Jewelry from Theft and Damage

Jewelry often holds immense sentimental and monetary value, making its protection a priority. Theft, loss, and damage are constant threats that require proactive measures. Whether it’s a cherished family heirloom or an expensive luxury piece, safeguarding your jewelry ensures its longevity and keeps it safe from harm. In this article, we’ll explore comprehensive strategies to protect your precious items from theft and damage.

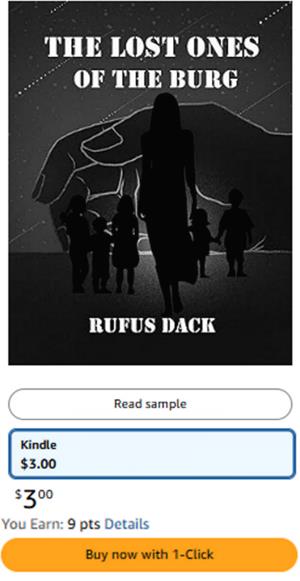

Which Car Loan is Best to Choose?

Buying a car is a significant investment, and for many people, taking out a car loan is the most practical way to afford it. But with so many options available, choosing the right car loan can feel overwhelming. The wrong choice could lead to higher costs, unexpected fees, or financial stress. In this guide, we’ll explore the factors you need to consider to determine which car loan is best for your needs and how to avoid common pitfalls.

Read more ...Decorating Your Home for Christmas

DIY Christmas Decorations

Decorating your home can be an exciting family activity that fosters creativity and connection. DIY decorations add a personal and heartfelt touch to your festive decor. Here are some simple yet impactful ideas:

Read more ...